will plug power continue to rise

Byrd raised his price target for Plug Power ticker. Plug Power has already and will continue to find great success in these expansion efforts.

Energy Saving Device Electrical Plug Energy Saving Devices Save Energy Energy Saver

The gains continued today with shares up another 11 as of 2 pm.

. Shares closed down 1. The 50 jump in the past two days still pales in comparison to. Shares of hydrogen fuel cell maker Plug Power NASDAQ.

The Timing Is Right. PLUG were red hot in 2019. The fuel cell stock plunged after the company reported its quarterly results.

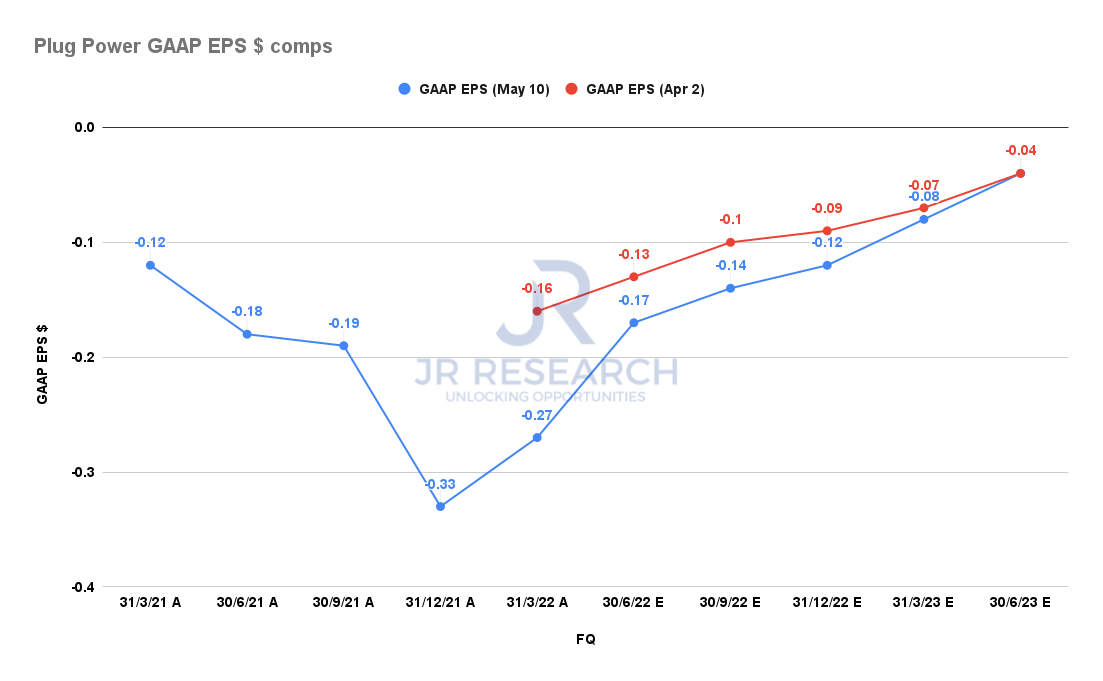

Fuel cell stock Plug Power PLUG 097 went on a roller-coaster ride Tuesday popping 31 in early morning trading before giving up all of those gains. Shares of hydrogen fuel cell HFC maker Plug Power NASDAQ. Plug reported a Q1 loss of 27 cents a share lower than expectations for a 16-cent loss.

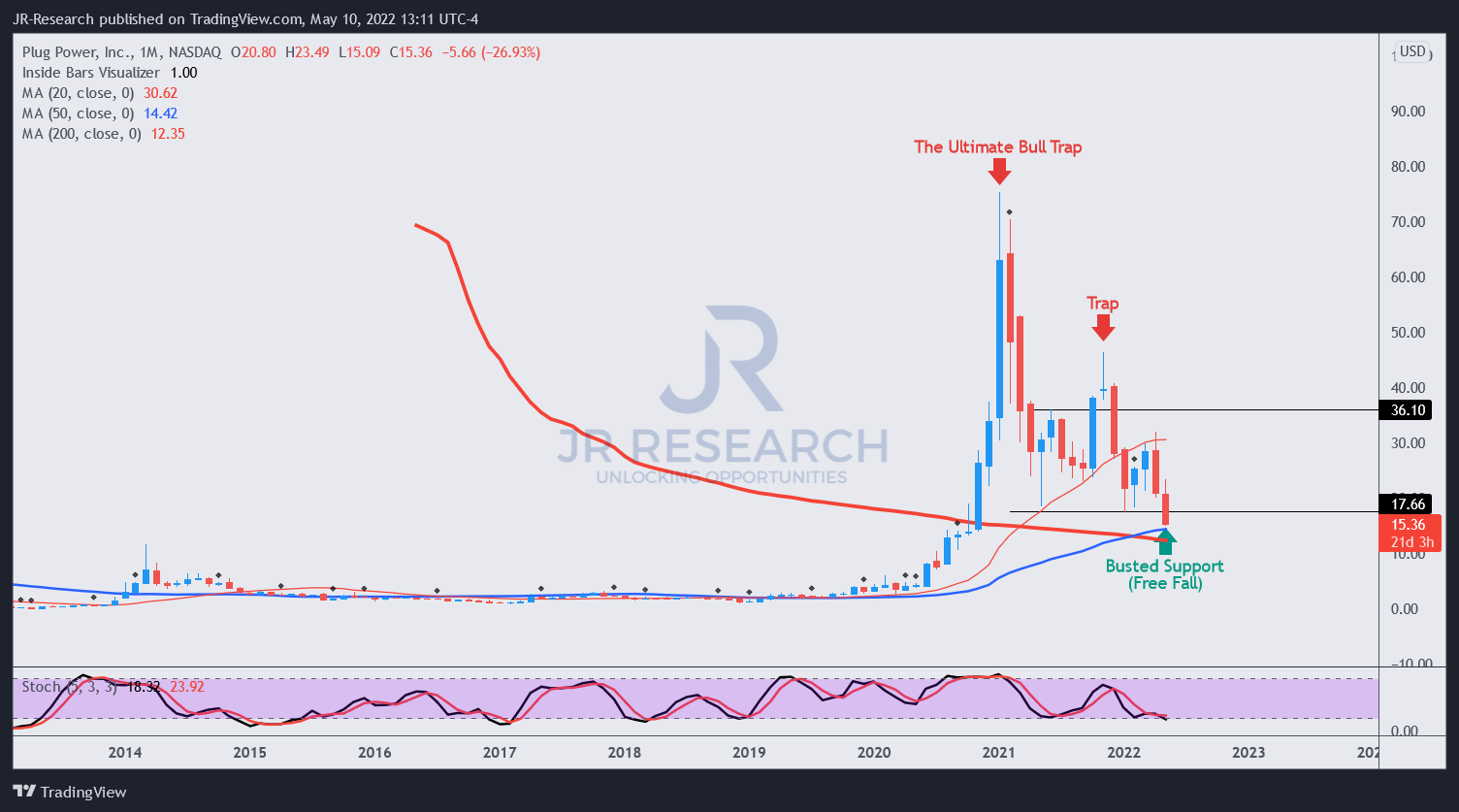

Plug Power IncPlug Power is building an end-to-end green hydrogen ecosystem from production storage and delivery to energy generationThe company plans to. PLUG stock rose more than 150 throughout the year as investors celebrated the companys ability. Heres How To Play The Trend Plug Power Daily Chart Analysis.

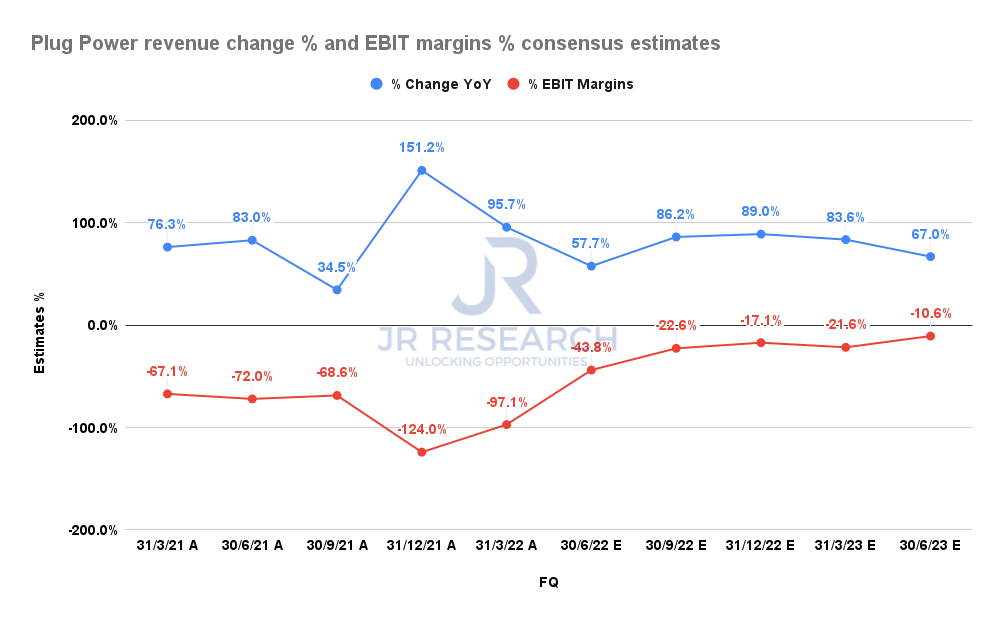

If management can deliver on those goals or anything close to those goals for that matter then Plug Powers growth trajectory will. Plug Power On the Rise. Revenue rose 96 to 1408 million but it also missed forecasts for 1448 million.

The plant will use 120 MW of. That includes today with shares up 15 as of 11 am. PLUG have been hammered amid the recent tech sector meltdown as a sharp rise in long-term yields has put significant downward pressure on.

Shares are up 90 in just the last five days. Price as of May 24 2022 400 pm. Plug Power PLUG -877 stock.

Plug Power NASDAQ. PLUG stock has been charged up latelyThat might even be an understatement. As North Americas largest green hydrogen production facility the plant will produce 45 metric tons of green liquid hydrogen daily servicing the Northeast region.

Revenue is seen rising 66 to 1138 million. But investors may be missing this key factor. Shares of hydrogen fuel cell HFC maker Plug Power NASDAQ.

But fundamentally theres plenty of room for the rally to continue. The first big reason to like Plug Power stock here is that the timing is perfect for exponential growth in the companys materials handling business. The stock looks to have formed a reversal pattern called a.

PLUG by 162 to 38 on Monday. Yesterday shares of Plug Power PLUG -366 rocketed 35. Thats because all these end-markets required core HFC technology and Plug Power has the best core HFC.

Plug Power PLUG stock is on the rise Thursday after announcing a massive 15 billion deal with Korean business company SK Group. PLUG were red hot in 2019. Plug Power stock fell late after closing sharply higher.

The Numbers Look Good. Plug Power IncNASDAQPLUG. The stock sank 143.

FuelCell Energy Plug Power Stocks Show Strength Against Market. Shareholders of hydrogen fuel cell maker Plug Power PLUG -331 have had a good week. The first one is slower-than-expected adoption of hydrogen fuel cells.

X The company said it had exceeded its 2020 gross billings targets and is raising its outlook for 2021 to 475 million from a. Plug Power aims to raise its annual revenue from 230 million in 2019 to 12 billion by 2024. Wells Fargo reported a 59 rise in.

At an 850 year-to-date gain Plug Power stock is one of. With a target of more than 15 gigawatts output from its planned gigafactory coupled. If the stock can bounce off the higher low trendline it may continue to.

Gross billings rose to. The Latham NY company said that it had exceeded its 2020 gross-billings target and is raising 2021 estimates to 475 million from 450 million. Plug Power nearing the support line is a possible opportunity for bullish traders.

After the pair of acquisitions Plug Power raised its 2024 guidance to 12 billion in. A loss of 18 cents per share on revenue of 1246 million. The second big reason.

As the demand for renewable energy sources is rising Plug Power PLUG is expected to gain significantly given the underlying strength in its business model short-and-long-term momentum impressive financial performance and favorable analyst sentiment. His new target is more than 15 above where shares were trading Monday afternoon.

Plug Power There S No Bottom In Sight Sell And Move On Nasdaq Plug Seeking Alpha

Where Will Plug Power Be In 5 Years The Motley Fool

Plug Power There S No Bottom In Sight Sell And Move On Nasdaq Plug Seeking Alpha

Plug Power There S No Bottom In Sight Sell And Move On Nasdaq Plug Seeking Alpha

Why Shares Of Plug Power Climbed 13 In March The Motley Fool

Ecowatt In 2021 Energy Saving Devices How To Find Out Save Energy

Why Shares Of Plug Power Plummeted 27 In April The Motley Fool

Bethlehem Approves 1 600 Job Plug Power Project

Save Electro Special Offer Page V4 Bc Np In 2021 Energy Saving Devices Save Energy Energy Saving Systems

Why Plug Power Stock Popped 10 On Monday The Motley Fool

Plug Power There S No Bottom In Sight Sell And Move On Nasdaq Plug Seeking Alpha

Bethlehem Approves 1 600 Job Plug Power Project

The Future Looks Bright For Plug Power Stock Says Analyst

Plug Power Earnings Disappoint Is Plug Stock A Buy Or Sell Investor S Business Daily

Why Plug Power Stock Surged 15 6 In February The Motley Fool

Plug Power There S No Bottom In Sight Sell And Move On Nasdaq Plug Seeking Alpha

Why Plug Power Stock Is Plunging Today The Motley Fool

Plug Power Earnings Disappoint Is Plug Stock A Buy Or Sell Investor S Business Daily

Plug Power Earnings Disappoint Is Plug Stock A Buy Or Sell Investor S Business Daily